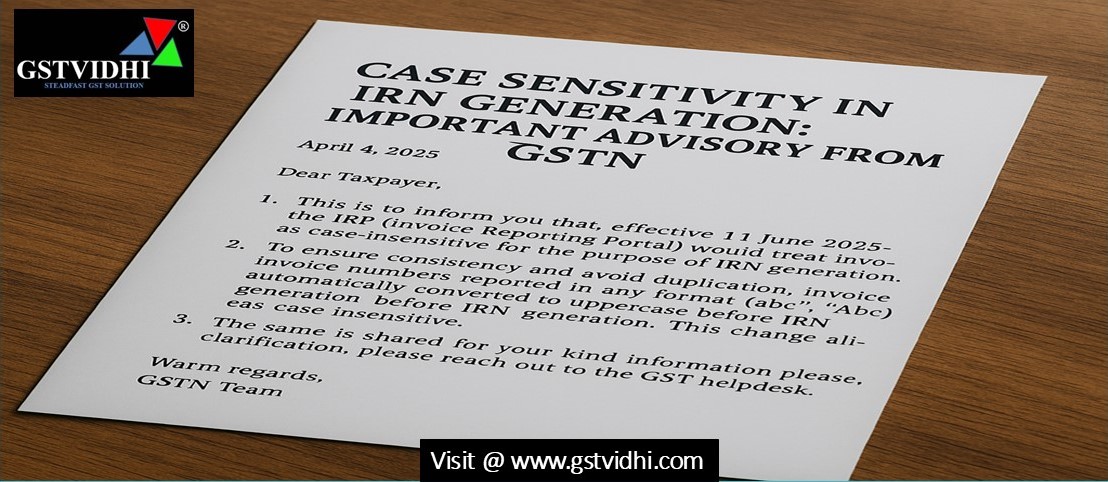

E Invoice Changes effective from 01.06.2025 / Case Sensitivity in

IRN Generation: Important Advisory from GSTN

Date of Advisory:

April 4, 2025

Effective Date of Change: June 1, 2025

Issued By: Goods and Services Tax Network (GSTN)

Introduction

With the increasing

adoption of e-invoicing under GST, the consistency and accuracy of invoice data

have become critical. To address issues related to invoice number duplication

and to bring uniformity with existing GST returns, the GSTN has released an important

advisory regarding the case sensitivity of invoice/document numbers

during IRN (Invoice Reference Number) generation.

What Has Been Announced?

Starting June 1, 2025,

the Invoice Reporting Portal (IRP) will treat invoice numbers as

case-insensitive for the purpose of IRN generation.

This means:

- Invoice numbers like “abc”, “ABC”,

and “Abc” will be considered identical.

- All invoice/document numbers

submitted to the IRP will be automatically converted to uppercase

before IRN generation.

Objective Behind This

Move

This update is aligned

with the current behavior of GSTR-1, which already treats invoice

numbers as case-insensitive. The primary objectives of this move are:

1. Uniformity:

Ensure consistent treatment of invoice numbers across all GST platforms.

2. Avoid

Duplication: Prevent duplicate IRNs from being

generated due to different cases in invoice numbers.

3. Ease

of Compliance: Simplify reconciliation of invoices

between IRP and GSTR-1.

Illustration

Let’s say a business

issues invoices with the following numbers:

- Invoice No. 001/abc

- Invoice No. 001/ABC

- Invoice No. 001/Abc

Before June 1, 2025:

All three may have been treated as different due to case variation.

After June 1, 2025:

All will be treated as “001/ABC”, i.e., converted to uppercase

before generating IRN.

As a result, only the

first invoice will get a valid IRN, and subsequent attempts with the same

characters (regardless of case) will be rejected as duplicates.

Impact on Taxpayers

1. System Adjustments

Businesses using

automated accounting or ERP software must ensure that:

- Invoice numbers are case-consistent.

- Duplicate checks consider uppercase

formats.

2. Avoid Rejections

Inconsistent casing in

invoice numbers can now lead to IRN generation failures due to perceived

duplication.

3. Best Practice

Recommendation

- Always use uppercase

for invoice/document numbers.

- Update billing software and ensure

internal teams are informed of this change.

Conclusion

This is a minor yet

impactful change in how the IRP handles invoice numbers. By treating them

as case-insensitive and converting them to uppercase, the GSTN is moving

towards a more robust and standardized system.

Taxpayers are advised to take

proactive steps before June 1, 2025, to align their systems with this

update and avoid disruptions in IRN generation.

Disclaimer: All the Information is based on the notification, circular and order issued by the Govt. authority and judgement delivered by the court or the authority information is strictly for educational purposes and on the basis of our best understanding of laws & not binding on anyone.

Click here