Payment Voucher Under GST and Consequences of Non-Compliance

What is a

Payment Voucher in GST?

Under the Goods and

Services Tax (GST) law, proper documentation is essential — especially when

you're paying tax under Reverse Charge Mechanism (RCM). One such

important document is the Payment Voucher.

Legal

Provision: Section 31(3)(g) of CGST Act, 2017

It states that:

“A registered person who

is liable to pay tax under Section 9(3) or Section 9(4) (i.e.,

under reverse charge) shall issue a payment voucher at the time of

making payment to the supplier.”

This rule ensures that

even when tax is paid by the recipient (and not the supplier), the

transaction is properly recorded.

When is a

Payment Voucher Required?

You need to issue a

payment voucher when:

- You’re a registered person under

GST, and

- You are making a payment to a supplier

who is supplying goods or services that are taxable under reverse

charge.

Even if the supplier is

unregistered, a payment voucher is still mandatory.

Special

Case: Import of Services from Associated Enterprises

In case you’re importing services

from an associated enterprise, the time of supply is determined based

on the date of payment or date of entry in the books, whichever is

earlier.

So, issuing a payment voucher becomes vital to establish the timeline

and comply with GST law.

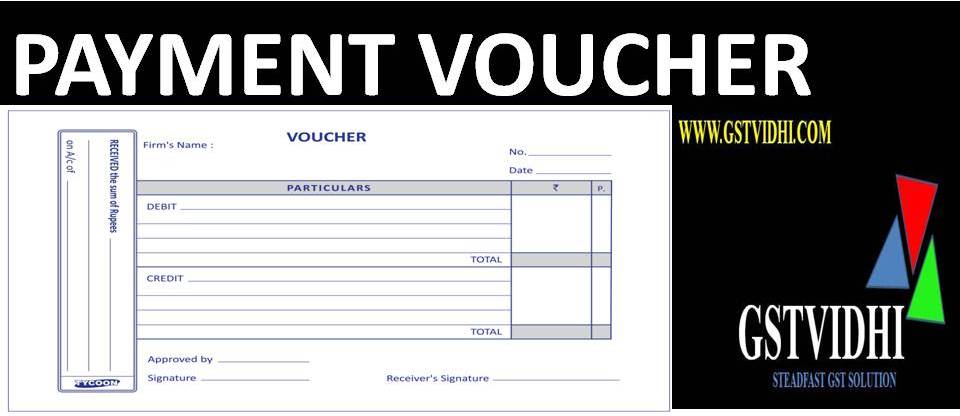

Contents of

a Payment Voucher (As per Rule 52 of CGST Rules)

A valid payment voucher

must include the following:

1. Supplier’s

Name, Address, and GSTIN (if registered)

2. A

Unique Serial Number (max 16 characters, can include

alphabets, numbers, "/", or "-")

3. Date

of Issue

4. Recipient’s

Name, Address, and GSTIN

5. Description

of Goods or Services

6. Amount

Paid

7. Rate

of GST (CGST, SGST/UTGST, IGST, Cess)

8. Amount

of GST Payable

9. Place

of Supply and State Code (for inter-State supply)

10. Signature

or Digital Signature of the supplier or their authorized

representative

Why is a

Payment Voucher Important?

- Acts as evidence of payment

made to the supplier

- Helps determine the time of supply

under reverse charge

- Supports claim for Input Tax

Credit (ITC) (if applicable)

- Ensures compliance with record-keeping

requirements under GST

Without issuing a payment

voucher, your books may be considered incomplete or inaccurate during

audit or inspection.

Consequences

of Not Issuing a Payment Voucher

As per Rule 56 of

the CGST Rules, every registered person must maintain proper records,

including:

- Invoices

- Bills of supply

- Delivery challans

- Payment vouchers

- Credit/debit notes

- Receipt vouchers, etc.

Penalty for

Non-Compliance: Section 122(1)(xvi)

If a taxable person fails

to keep or maintain books of accounts or documents as required under GST

law:

- Penalty under CGST Act:

₹10,000

- Penalty under SGST Act:

₹10,000

Total

penalty = ₹20,000

This penalty applies even

if the tax was paid correctly but supporting documents like payment vouchers

were not maintained.

Illustrative

Example

Scenario:

ABC Ltd. (registered under GST) receives legal consultancy services from Mr. X

(an unregistered advocate). Legal services are taxable under RCM.

ABC Ltd. must:

1. Pay

GST under reverse charge.

2. Issue

a self-invoice (since Mr. X is unregistered).

3. Issue

a payment voucher at the time of making payment to Mr. X.

Failing to issue the

payment voucher will be treated as non-compliance, and may attract

penalties.

Conclusion

The requirement to issue

a Payment Voucher under GST is not just a formality — it's a statutory

obligation that plays a key role in:

- Complying with Reverse Charge

Mechanism,

- Ensuring transparency in

transactions,

- Determining time of supply,

- Avoiding legal penalties.

Disclaimer: All the Information is based on the notification, circular and order issued by the Govt. authority and judgement delivered by the court or the authority information is strictly for educational purposes and on the basis of our best understanding of laws & not binding on anyone.

Find the Attachment (Press on Click Here )

Click here