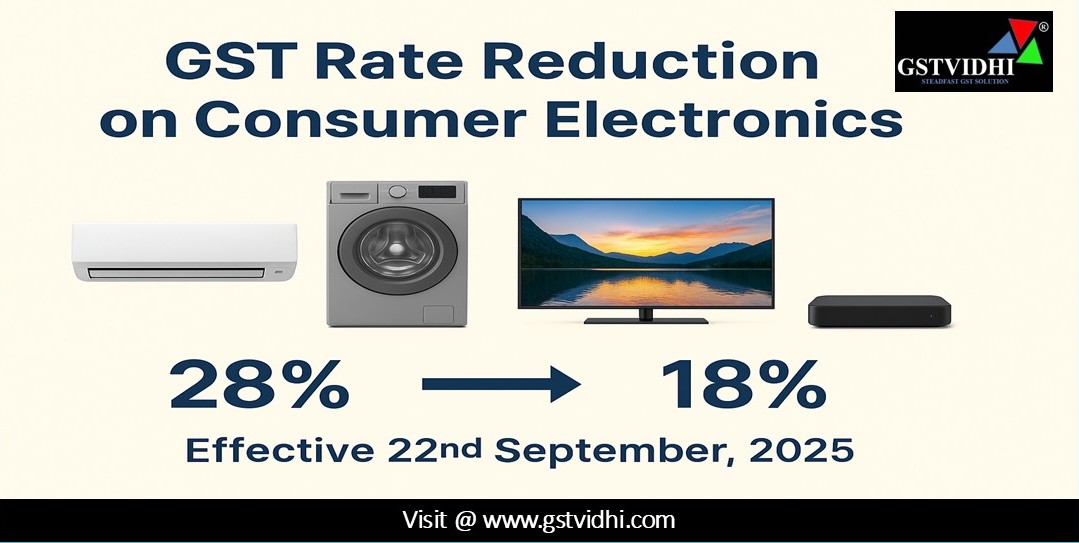

New GST Rate On Air Conditioning Machines, Dish Washing

Machines, Television Sets / New GST Rate on Consumer Electronics – Key

Highlights from the 56th GST Council Meeting

The 56th meeting of

the GST Council, held on 3rd September 2025 at Sushma Swaraj

Bhavan, New Delhi under the chairpersonship of Union Finance &

Corporate Affairs Minister Smt. Nirmala Sitharaman, brought much-needed

relief to consumers and industry stakeholders alike.

One of the most

significant announcements was the reduction of GST rates on consumer

electronics from 28% to 18%, effective 22nd September 2025.

This move is aimed at

benefiting the common man, aspirational middle class, and trade &

industry, making essential home appliances and electronics more affordable.

Goods

Covered Under the Rate Reduction

The following categories

of consumer electronics will now attract 18% GST instead of 28%:

|

S.

No.

|

Chapter

/ Heading / Tariff Item

|

Description

of Goods

|

|

1

|

8415

|

Air-conditioning

machines, comprising a motor-driven fan and elements for

changing temperature and humidity, including those where humidity cannot be

separately regulated

|

|

2

|

8422

|

Dish

washing machines – household [8422 11 00] and other

[8422 19 00]

|

|

3

|

8528

|

Television

sets (including LCD/LED TVs); monitors and

projectors not incorporating TV reception apparatus; reception apparatus for

television (with/without radio, sound, or video recording); set-top boxes

|

Impact of

the GST Rate Reduction

1. Cheaper

Consumer Durables – The reduction from 28% to 18%

will directly lower the prices of air-conditioners, dishwashers, and television

sets.

2. Boost

to Middle-Class Consumption – Electronics like ACs and TVs are

aspirational products for the growing middle class, and reduced tax burden will

encourage higher demand.

3. Industry

Relief – The consumer durables sector has long requested

rationalization of GST rates, and this decision is expected to stimulate sales

and inventory turnover.

4. Support

to Trade – Lower compliance burden and increased affordability

will drive growth in both urban and semi-urban markets.

Frequently

Asked Questions (FAQs)

To address potential

doubts, the GST Council has also issued clarifications. Below are some key

queries:

1. When will the new GST

rates apply?

- The revised rates will be effective from

22nd September 2025.

2. Which notification

will give effect to the revised rates?

- The changes will be notified through

the Official Gazette notifications under the CGST, SGST/UTGST, and

IGST Acts.

- Notifications will also be published

on the CBIC website.

3. What happens if supply

was made before the change but invoice issued later?

- As per Section 14(a)(i), CGST Act

2017:

- If payment is received after the

rate change → time of supply = earlier of payment date or invoice

date.

- If payment was received before

the rate change → time of supply = date of payment.

4. What if advances were

received but supply/invoice is pending?

- The applicable GST rate will be

determined as per time of supply provisions under Section 14.

5. What happens to ITC on

purchases made before the change?

- As per Section 16(1), CGST Act

2017, ITC is available for the tax charged at the prevailing rate at

the time of supply.

- Subsequent rate reductions do not

affect the entitlement to ITC, provided conditions under Section 49

are met.

6. Can I use ITC accrued

at higher rates for outward supplies now taxed at lower rates?

- Yes. Once ITC is duly credited in the

electronic credit ledger, it can be used to pay any output tax

liability as per Section 49(4), CGST Act 2017, irrespective of

later changes in GST rates.

Conclusion

The reduction of GST

rates on consumer electronics from 28% to 18% marks a significant

pro-consumer and pro-industry reform by the GST Council. By making essential

and aspirational home appliances more affordable, the decision is expected to boost

household consumption, support the manufacturing sector, and increase market

penetration of durable goods.

The accompanying FAQs

provide necessary clarity to ensure smooth transition and compliance for

taxpayers and businesses.

This rationalization of

rates demonstrates the Council’s continued efforts to balance revenue

interests with consumer welfare while fostering ease of doing business.

Disclaimer: All the Information is based on the notification, circular advisory and order issued by the Govt. authority and judgement delivered by the court or the authority information is strictly for educational purposes and on the basis of our best understanding of laws & not binding on anyone.

Press On Click Here To Download Order File

Click here