GST Rate Changes in the Textile Sector – 56th GST Council

Meeting

The 56th GST Council

Meeting, held on 3rd September 2025 at Sushma Swaraj Bhavan, New

Delhi under the chairpersonship of Union Finance & Corporate Affairs

Minister Smt. Nirmala Sitharaman, introduced major rationalizations in

the textile sector.

The Council has

recommended significant GST rate changes across yarns, fabrics, floor

coverings, apparel, and made-up articles to boost industry competitiveness,

support MSMEs, and provide relief to consumers.

Key GST

Rate Changes

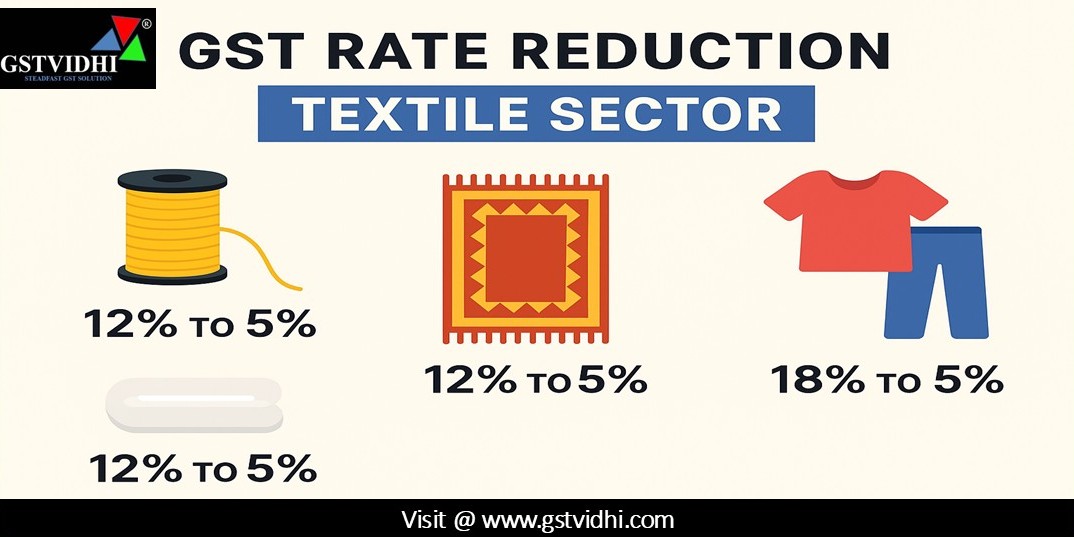

A. Reduction from 12% to

5%

Applicable to yarns,

sewing threads, wadding, felt, carpets, embroidery, technical textiles, and

certain headgear.

|

S.

No.

|

Chapter

/ Heading

|

Description

of Goods

|

|

1

|

5401

|

Sewing

thread of manmade filaments, whether or not put up for retail sale

|

|

2

|

5402–5406

|

Synthetic

or artificial filament yarns

|

|

3

|

5508

|

Sewing

thread of manmade staple fibres

|

|

4

|

5509–5511

|

Yarn

of manmade staple fibres

|

|

5

|

5601

|

Wadding

of textile materials and articles thereof (e.g., absorbent cotton wool,

except cigarette filter rods)

|

|

6–12

|

5602–5609

|

Felt,

nonwovens, rubberized threads, metallised yarns (excluding zari), gimped

yarns, twine, cordage, ropes, and articles thereof

|

|

13–17

|

5701–5705

|

Various

types of carpets and textile floor coverings (knotted, woven, tufted,

felt-based, and handloom mats/rugs)

|

|

18–27

|

5802–5901

|

Terry

towelling fabrics, gauze, tulles, laces, tapestries, labels, braids, zari

borders, embroidery, quilted products, coated fabrics

|

|

28–37

|

5902–5911

|

Tyre

cord fabric, laminated fabrics, linoleum, wall coverings, rubberized fabrics,

painted canvas, textile hose piping, conveyor belts, and technical textile

products

|

|

38–39

|

6501,

6505

|

Textile

caps; hats (knitted, crocheted, or made up from lace or other fabrics)

|

|

40

|

9404

|

Quilted

textile products not exceeding ₹2500 per piece

|

B. No Change in Rate

(Continues at 5%) – Value-based Relief

|

Chapter

|

Description

|

Condition

|

|

61

|

Knitted/crocheted

apparel & clothing accessories

|

Value

≤ ₹2500 per piece

|

|

62

|

Non-knitted

apparel & clothing accessories

|

Value

≤ ₹2500 per piece

|

|

63

(excl. 63053200, 63053300, 6309)

|

Other

made-up textile articles & sets

|

Value

≤ ₹2500 per piece

|

|

9404

|

Cotton

quilts

|

Value

≤ ₹2500 per piece

|

C. Reduction from 18% to

5%

|

Chapter

|

Description

|

|

5402,

5404, 5406

|

All

goods

|

|

5403,

5405, 5406

|

All

goods

|

|

5501,

5502

|

Synthetic

or artificial filament tow

|

|

5503,

5504, 5506, 5507

|

Synthetic

or artificial staple fibres

|

|

5505

|

Waste

of manmade fibres

|

D. Increase from 12% to

18% (Value > ₹2500 per piece)

|

Chapter

|

Description

|

|

61

|

Knitted/crocheted

apparel & clothing accessories

|

|

62

|

Non-knitted

apparel & clothing accessories

|

|

63

(excl. 6309)

|

Other

made-up textile articles, sets (other than worn clothing, rags)

|

|

9404

|

Cotton

quilts exceeding ₹2500 per piece

|

|

9404

|

Quilted

textile products exceeding ₹2500 per piece

|

Impact of

the Rate Changes

1. Boost

to Domestic Manufacturing – Yarn, filament, and fibres used in

spinning/weaving will become cheaper, reducing input costs for small and medium

textile manufacturers.

2. Consumer

Relief – Everyday textile items like towels, carpets, mats,

and hats will attract a lower rate, making them more affordable.

3. Encouragement

to Handloom & MSME Sector – Handloom rugs, cotton

mats, and zari-related products benefit from rationalized rates.

4. Value-based

Differentiation in Apparel – Low-value garments (≤ ₹2500 per

piece) continue at 5%, while high-value garments (> ₹2500) will now attract

18%, creating a progressive tax structure.

5. Technical

Textiles Growth – Lower GST on conveyor belts, tyre

cords, rubberized fabrics, and other industrial textiles will help the

technical textile segment expand.

Clarifications

(FAQs – Textile Sector Specific)

- Effective Date

– Changes apply from 22nd September 2025.

- Input Tax Credit (ITC)

– ITC is available at the rate applicable at the time of supply;

subsequent rate reductions will not impact credit eligibility.

- High vs. Low Value Garments

– Apparel ≤ ₹2500 remains at 5%, while > ₹2500 will now attract 18%.

- Export Benefit

– Exporters will benefit as input costs reduce due to lower GST on fibres

and yarns.

Conclusion

The GST rate

rationalization in the textile sector is a landmark step to strengthen one

of India’s largest employment-generating industries. By reducing GST from 12%

to 5% on yarns, fibres, carpets, and technical textiles, and rationalizing

apparel rates based on value, the Council has aimed to strike a balance between

industry growth, consumer relief, and revenue needs.

This reform is expected

to energize MSMEs, encourage exports, and make textile products more

affordable for households, while aligning tax rates with global best

practices.

Disclaimer: All the Information is based on the notification, circular advisory and order issued by the Govt. authority and judgement delivered by the court or the authority information is strictly for educational purposes and on the basis of our best understanding of laws & not binding on anyone.

Press On Click Here To Download Order File

Click here