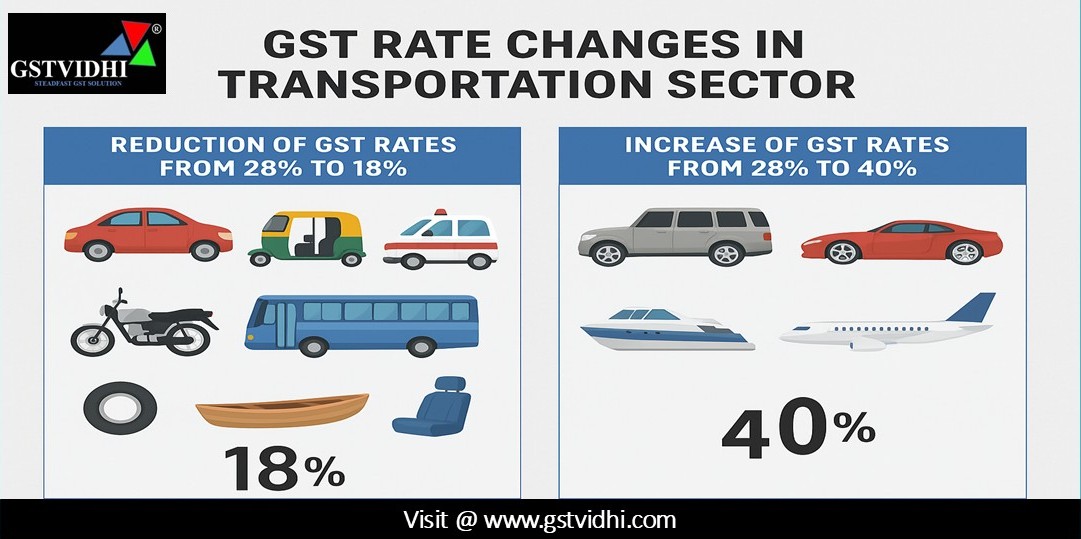

GST Rate Changes in Transportation Sector - New GST Rate on

Motor Vehicles, Cars, Bikes, Tractors, Bicycles

Introduction

The 56th GST Council

meeting held on 3rd September, 2025 at Sushma Swaraj Bhavan, New

Delhi, chaired by Union Finance & Corporate Affairs Minister Smt. Nirmala

Sitharaman, brought significant changes in the transportation sector under

GST.

The decisions reflect a two-fold

approach:

- Providing relief to the common man

and middle class by reducing GST rates on small cars, ambulances,

buses, three-wheelers, motorcycles up to 350cc, and essential vehicle

parts.

- Increasing GST rates on luxury and

high-end personal transport such as large cars, SUVs, big motorcycles,

yachts, and personal aircraft, thereby ensuring equitable revenue

generation.

The revised rates are

expected to boost affordability, support domestic automobile demand, and

promote a balanced taxation framework.

Changes in

GST Rates – Transportation Sector

Reduction

of GST Rates from 28% to 18%

|

S.

No.

|

HSN

Code

|

Description

of Goods

|

Revised

GST Rate

|

|

1

|

4011

|

New

pneumatic tyres of rubber (other than bicycle/aircraft tyres, rear tractor

tyres)

|

18%

|

|

2

|

8701

|

Road

tractors for semi-trailers (>1800 cc engine capacity)

|

18%

|

|

3

|

8702

|

Motor

vehicles for transport of 10+ persons (excluding bio-fuel buses for public

transport)

|

18%

|

|

4

|

8703

|

Small

petrol/LPG/CNG cars (≤1200cc, ≤4000mm length)

|

18%

|

|

5

|

8703

|

Small

diesel cars (≤1500cc, ≤4000mm length)

|

18%

|

|

6

|

8702

/ 8703

|

Ambulances

with complete fitments

|

18%

|

|

7

|

8703

|

Three-wheelers

|

18%

|

|

8

|

8703

40 / 8703 60

|

Small

hybrid cars (≤1200cc petrol/electric, ≤4000mm length)

|

18%

|

|

9

|

8703

50 / 8703 70

|

Small

hybrid cars (≤1500cc diesel/electric, ≤4000mm length)

|

18%

|

|

10

|

8704

|

Goods

transport vehicles (other than refrigerated)

|

18%

|

|

11

|

8706

|

Chassis

fitted with engines (8701–8705)

|

18%

|

|

12

|

8707

|

Bodies

(including cabs) for vehicles (8701–8705)

|

18%

|

|

13

|

8708

|

Parts

& accessories of motor vehicles (8701–8705, except tractors)

|

18%

|

|

14

|

8711

|

Motorcycles

and mopeds ≤350cc (including sidecars)

|

18%

|

|

15

|

8714

|

Parts

& accessories of motorcycles (heading 8711)

|

18%

|

|

16

|

8903

|

Rowing

boats and canoes

|

18%

|

|

17

|

9401

20 00

|

Seats

of a kind used for motor vehicles

|

18%

|

Increase of

GST Rates from 28% to 40%

|

S.

No.

|

HSN

Code

|

Description

of Goods

|

Revised

GST Rate

|

|

1

|

8703

|

Luxury

motor cars and vehicles (excluding small cars, ambulances, three-wheelers,

and hybrids at concessional rates)

|

40%

|

|

2

|

8703

40 / 8703 60

|

Large

hybrid petrol/electric cars (>1200cc or >4000mm)

|

40%

|

|

3

|

8703

50 / 8703 70

|

Large

hybrid diesel/electric cars (>1500cc or >4000mm)

|

40%

|

|

4

|

8711

|

Motorcycles

exceeding 350cc

|

40%

|

|

5

|

8802

|

Aircraft

for personal use

|

40%

|

|

6

|

8903

|

Yachts

and vessels for pleasure/sports

|

40%

|

FAQs on GST

Rate Changes in Transportation Sector

Q1. What is the revised

GST rate on small petrol, LPG, CNG, or diesel cars? What is covered under small

cars?

The GST rate on all small

cars has been reduced from 28% to 18%.

- Petrol/LPG/CNG cars = Engine ≤1200

cc, length ≤4000 mm

- Diesel cars = Engine ≤1500 cc, length

≤4000 mm

Q2. What is the new GST

rate on vehicles exceeding 1500 cc or length exceeding 4000 mm? What is the GST

rate on utility vehicles?

Ans: All mid-size and

large cars (engine >1500 cc or length >4000 mm) will attract 40% GST.

Utility Vehicles (SUV,

MUV, MPV, XUV, etc.) with engine >1500 cc, length >4000 mm, and ground

clearance ≥170 mm will also attract 40% GST without any cess.

Q3. What is the GST rate

on 3-wheelers?

Ans: 18% (reduced

from 28%).

Q4. What is the GST rate

on buses and vehicles meant to carry 10+ persons including the driver?

Ans: 18% (reduced

from 28%).

Q5. What is the GST rate

on ambulances?

Ans: 18% (reduced

from 28%).

Q6. What is the GST rate

on goods transport vehicles such as lorries and trucks?

Ans: 18% (reduced

from 28%).

Q7. What is the GST rate

on trailers and semi-trailers of tractors?

Ans: Tractors (other than road tractors for

semi-trailers above 1800cc) = 5%

Road tractors for semi-trailers (>1800cc) = 18% (reduced from 28%)

Q8. What is the GST rate

on motorcycles?

Ans:

Up

to 350cc = 18%

Above

350cc = 40%

Q9. Does 18% apply to

350cc motorcycles too?

Ans:

Yes,

motorcycles up to and including 350cc = 18%.

Only

those exceeding 350cc = 40%.

Q10. Earlier mid-size and

big cars attracted 28% GST + 17–22% cess (total 45–50%). What will be the new

rate?

Ans:

The

new rate is 40% flat GST, with no cess.

Q11. Has GST been reduced

on bicycles and parts?

Ans:

Yes,

from 12% to 5%.

Q12. Why has small

agricultural tractors not been fully exempted?

Ans:

Full

exemption would block ITC for manufacturers, increasing costs that would be

passed on to farmers. A concessional rate ensures relief without harming

domestic producers.

Conclusion

The 56th GST Council

meeting’s transportation sector decisions strike a balance between affordability

for essential vehicles and higher taxation for luxury goods.

- The move from 28% to 18% on

small cars, three-wheelers, ambulances, buses, motorcycles ≤350cc, and

essential parts is a big relief for the middle class and trade sectors.

- The hike from 28% to 40% on

luxury cars, SUVs, large motorcycles, yachts, and personal aircraft

ensures that luxury consumption bears a fairer tax burden.

Overall, the changes are

expected to encourage growth in the automobile sector, promote mobility for

the common man, and rationalize GST collection.

Disclaimer: All the Information is based on the notification, circular advisory and order issued by the Govt. authority and judgement delivered by the court or the authority information is strictly for educational purposes and on the basis of our best understanding of laws & not binding on anyone.

Click here