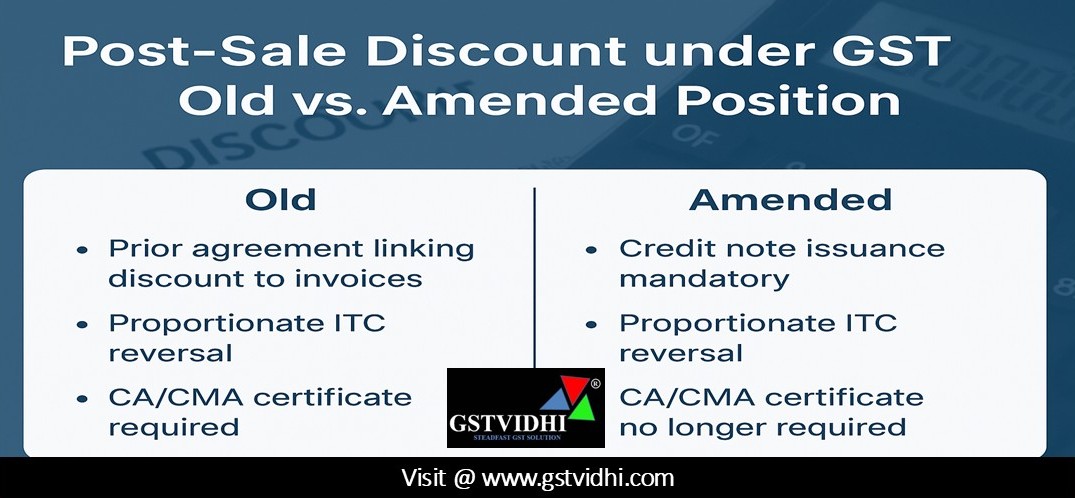

Post Sale Discount under GST – Old vs. Amended Position

Introduction

Post-sale discounts are a

common business practice where suppliers offer incentives to buyers after the

supply of goods or services has been completed. Under the Goods and Services

Tax (GST) regime, the treatment of such discounts has always been a matter of

concern due to its direct impact on the value of taxable supply, issuance of

credit notes, and reversal of Input Tax Credit (ITC). Over the years, several

disputes and compliance challenges have arisen, prompting the government to

issue clarifications and subsequently amend the law. The recent recommendations

of the GST Council in September 2025 mark a significant shift in how post-sale

discounts are treated under GST.

Earlier

Legal Framework

Section 15(3)(b) of the

CGST Act, 2017 provided that post-sale discounts shall be excluded from the

value of supply only if:

1. The

discount was agreed upon in terms of a prior agreement (entered into at or

before the time of supply).

2. The

discount was specifically linked to relevant invoices.

3. The

recipient reversed the proportionate ITC attributable to such discounts.

To operationalize these

conditions, the CBIC issued Circular No. 212/6/2024-GST dated 26th June 2024.

The circular mandated suppliers to obtain proof from recipients that ITC had

been reversed. For discounts exceeding ₹5 lakh in a financial year, a certificate

from a Chartered Accountant (CA) or Cost Accountant (CMA) was required. For

smaller amounts, an undertaking from the recipient was sufficient.

This framework, though

legally precise, placed an additional compliance burden on businesses.

Suppliers often faced practical difficulties in obtaining timely

certifications, while recipients hesitated to reverse ITC, leading to disputes

and litigations.

Amendment

in Post Sale Discount Provisions

Recognizing the

hardships, the 56th GST Council Meeting held on 3rd September 2025

recommended key changes:

- Omission of Section 15(3)(b)(i):

The requirement of a prior agreement linking discounts to invoices has

been removed. This simplifies documentation and acknowledges that many

commercial discounts are dynamic and not predetermined.

- Amendment of Section 15(3)(b) and

Section 34: The law now provides that post-sale

discounts should be granted strictly through a GST credit note

issued under Section 34. Correspondingly, Section 34 has been amended to

explicitly cover discounts under Section 15(3)(b).

- Reversal of ITC:

ITC reversal by the recipient continues to be mandatory whenever value of

supply is reduced through a GST credit note.

- Rescission of Circular 212/6/2024:

Since the requirement of CA/CMA certification created compliance

bottlenecks, the circular stands withdrawn. Instead, the amended law

itself ensures clarity and uniformity.

Practical

Impact of the Change

1. Simplified

Compliance: Businesses no longer need to rely on

CA/CMA certificates for ITC reversal, thereby reducing cost and administrative

burden.

2. Certainty

in Transactions: Removal of the “prior agreement”

condition provides relief to suppliers, especially in industries where

discounts are offered on seasonal or volume-based performance.

3. Reduced

Litigation: Clear legislative backing replaces

interpretational circulars, minimizing scope for disputes between taxpayers and

authorities.

4. Continuing

ITC Safeguard: The requirement of ITC reversal ensures

that both supplier and recipient maintain tax neutrality, preventing revenue

leakage.

5. Industry

Benefit: Sectors like FMCG, automobiles, and electronics,

where post-sale discounts are prevalent, will experience smoother business

operations.

Conclusion

The treatment of

post-sale discounts under GST has undergone a major transformation. Earlier,

compliance was heavily documentation-driven, relying on CA/CMA certificates and

prior agreements. With the latest amendment, the law has been simplified:

discounts granted through credit notes can reduce taxable value, subject only

to reversal of ITC by the recipient. This change strikes a balance between

trade facilitation and revenue protection.

The amendment is a

welcome move as it reduces compliance complexities, aligns GST provisions with

commercial realities, and provides much-needed clarity to taxpayers. Businesses

should now focus on timely issuance of GST credit notes and ensuring proper ITC

reversal documentation to remain compliant in the new regime.

Disclaimer: All the Information is based on the notification, circular advisory and order issued by the Govt. authority and judgement delivered by the court or the authority information is strictly for educational purposes and on the basis of our best understanding of laws & not binding on anyone.

Click here