GST Rate Changes in the Food Sector – 56th GST Council Meeting

(3rd September 2025)

The 56th meeting of

the GST Council, held on 3rd September 2025 at Sushma Swaraj

Bhavan, New Delhi, under the chairpersonship of Union Finance &

Corporate Affairs Minister Smt. Nirmala Sitharaman, brought significant

changes to the Goods and Services Tax (GST) rates applicable to the food

sector.

These changes are aimed

at providing relief to the common man and aspirational middle class,

while also ensuring uniform tax treatment to avoid misclassification and

disputes. The Council has also issued FAQs to clarify the rationale

behind rate rationalisation.

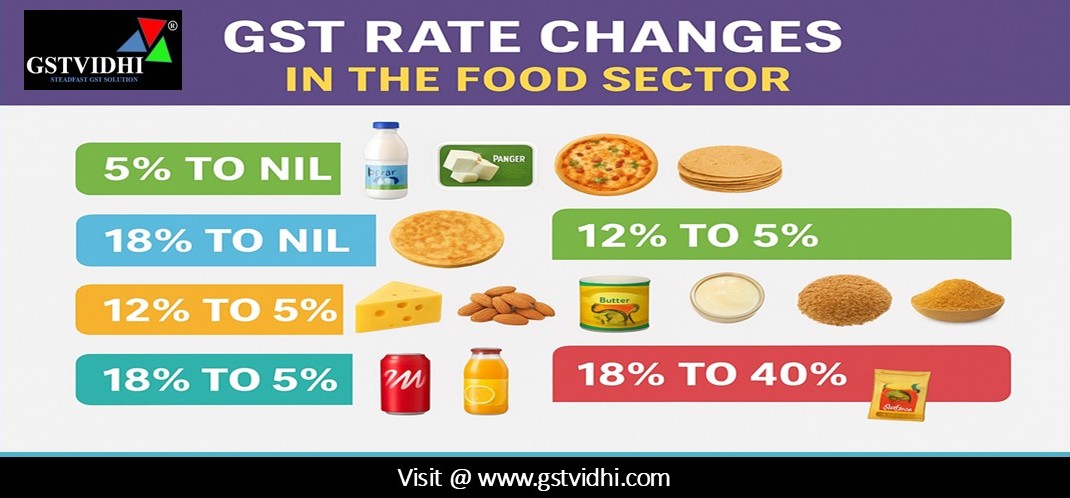

Food Sector – GST Rate Change (From 5% →

Nil)

|

S.

No.

|

Chapter

/ Heading / Sub-heading / Tariff Item

|

Description

of Goods

|

|

1

|

0401

|

Ultra-High

Temperature (UHT) milk

|

|

2

|

0406

|

Chena

or paneer, pre-packaged and labelled

|

|

3

|

1905

|

Pizza

bread

|

|

4

|

1905

or 2106

|

Khakhra,

chapathi or roti

|

Food Sector – GST Rate Change (From 18% →

Nil)

|

S.

No.

|

Chapter

/ Heading / Sub-heading / Tariff Item

|

Description

of Goods

|

|

1

|

2106

|

Paratha,

parotta and other Indian breads by any name called

|

Food Sector – GST Rate Change (From 12% →

5%)

|

S.

No.

|

Chapter

/ Heading / Sub-heading / Tariff Item

|

Description

of Goods

|

|

1

|

0402

91 10, 0402 99 20

|

Condensed

milk

|

|

2

|

0405

|

Butter

and other fats (ghee, butter oil, etc.) and oils derived from milk; dairy

spreads

|

|

3

|

0406

|

Cheese

|

|

4

|

0801

|

Brazil

nuts, dried, whether or not shelled or peeled

|

|

5

|

0802

|

Other

dried nuts (Almonds, Hazelnuts, Chestnuts, Pistachios, Macadamia nuts, Kola

nuts, Pine nuts) [other than dried areca nuts]

|

|

6

|

0804

|

Dates

(soft or hard), figs, pineapples, avocados, guavas, mangoes (other than dried

sliced mangoes), mangosteens, dried

|

|

7

|

0805

|

Citrus

fruit, dried (Oranges, Mandarins, Clementines, Grapefruit, Lemons, Limes,

etc.)

|

|

8

|

0813

|

Fruit,

dried (other than 0801 to 0806); mixtures of nuts or dried fruits [other than

dried tamarind]

|

|

9

|

1108

|

Starches;

inulin

|

|

10

|

1501

|

Pig

fats (including lard) and poultry fat, other than 0209 or 1503

|

|

11

|

1502

|

Fats

of bovine animals, sheep or goats, other than 1503

|

|

12

|

1503

|

Lard

stearin, lard oil, oleo stearin, oleo-oil, tallow oil, not

emulsified/mixed/prepared

|

|

13

|

1504

|

Fats

and oils of fish or marine mammals, refined/not, but not chemically modified

|

|

14

|

1505

|

Wool

grease and fatty substances (including lanolin)

|

|

15

|

1506

|

Other

animal fats and oils, refined/not, but not chemically modified

|

|

16

|

1516

|

Animal

or microbial fats/oils, hydrogenated, re-esterified, elaidinised, refined but

not further prepared

|

|

17

|

1517

|

Edible

mixtures of animal/microbial fats or oils (other than those of 1516)

|

|

18

|

1518

|

Chemically

modified fats/oils; inedible mixtures of animal, vegetable, microbial

fats/oils not elsewhere specified

|

|

19

|

1601

|

Sausages

and similar products of meat, offal, blood or insects; food preparations

based on these

|

|

20

|

1602

|

Other

prepared/preserved meat, meat offal, blood or insects

|

|

21

|

1603

|

Extracts

and juices of meat, fish, crustaceans, molluscs or other aquatic

invertebrates

|

|

22

|

1604

|

Prepared

or preserved fish; caviar and substitutes

|

|

23

|

1605

|

Prepared

or preserved crustaceans, molluscs and other aquatic invertebrates

|

|

24

|

1701

91, 1701 99

|

Refined

sugar with added flavouring/colouring, sugar cubes (other than those at

5%/Nil)

|

|

25

|

1704

|

Sugar

boiled confectionery

|

|

26

|

1902

|

Pasta

(spaghetti, macaroni, noodles, lasagne, ravioli, couscous etc.),

cooked/stuffed/prepared

|

|

27

|

1905

90 30

|

Extruded/expanded

savoury or salted products (other than un-fried/un-cooked snack pellets)

|

|

28

|

2001

|

Vegetables,

fruit, nuts prepared/preserved by vinegar/acetic acid

|

|

29

|

2002

|

Tomatoes

prepared/preserved otherwise than by vinegar/acetic acid

|

|

30

|

2003

|

Mushrooms

and truffles prepared/preserved otherwise than by vinegar/acetic acid

|

|

31

|

2004

|

Frozen

vegetables (other than 2006)

|

|

32

|

2005

|

Non-frozen

vegetables prepared/preserved (other than 2006)

|

|

33

|

2006

|

Vegetables,

fruit, nuts, fruit-peel preserved by sugar (drained, glacé, crystallised)

|

|

34

|

2007

|

Jams,

jellies, marmalades, fruit/nut purées or pastes (with/without added sugar)

|

|

35

|

2008

|

Other

prepared/preserved fruits, nuts, edible plant parts (e.g., roasted cashews,

groundnuts, squash drinks, etc.)

|

|

36

|

2009

|

Fruit

or vegetable juices, unfermented, with/without sugar

|

|

37

|

2009

89 90

|

Tender

coconut water, pre-packaged and labelled

|

|

38

|

2101

30

|

Roasted

chicory & coffee substitutes, extracts, essences, concentrates

|

|

39

|

2102

|

Yeasts

(active/inactive); other microorganisms (dead); baking powders

|

|

40

|

2103

|

Sauces,

condiments, curry paste, mayonnaise, salad dressings, prepared mustard

|

|

41

|

2106

|

Texturised

vegetable proteins (soya bari), pulse-based bari (mungodi), batters

|

|

42

|

2106

90

|

Namkeens,

bhujia, mixtures, chabena, etc. (ready-to-eat, pre-packaged & labelled)

|

|

43

|

2106

90 91

|

Diabetic

foods

|

|

44

|

2201

|

Drinking

water packed in 20 litre bottles

|

|

45

|

2202

99 10

|

Soya

milk drinks

|

|

46

|

2202

99 20

|

Fruit

pulp/fruit juice-based drinks [other than carbonated drinks with juice]

|

|

47

|

2202

99 30

|

Beverages

containing milk

|

Food Sector – GST Rate Change (From 18% →

5%)

|

S.

No.

|

Chapter

/ Heading / Sub-heading / Tariff Item

|

Description

of Goods

|

|

1

|

1107

|

Malt,

whether or not roasted

|

|

2

|

1302

|

Vegetable

saps and extracts; pectic substances, pectinates and pectates; agar-agar and

other mucilages and thickeners, derived from vegetable products [other than

tamarind kernel powder]

|

|

3

|

1517

10

|

All

goods i.e. Margarine, Linoxyn

|

|

4

|

1520

00 00

|

Glycerol,

crude; glycerol waters and glycerol lyes

|

|

5

|

1521

|

Vegetable

waxes (other than triglycerides), Beeswax, other insect waxes and spermaceti,

refined or not, coloured or not

|

|

6

|

1522

|

Degras;

residues from treatment of fatty substances or animal/vegetable waxes

|

|

7

|

1702

|

Other

sugars (chemically pure lactose, maltose, glucose, fructose in solid form,

sugar syrups, artificial honey, caramel) [other than palmyra sugar &

palmyra jaggery]

|

|

8

|

1704

|

Sugar

confectionery [other than mishri, batasha, bura, sakar, khadi sakar, harda,

sakariya, gatta, kuliya, elaichidana, lukumdana, traditional chikkis, sugar

makhana, groundnut sweets, gajak, sugar boiled confectionery]

|

|

9

|

1804

|

Cocoa

butter, fat and oil

|

|

10

|

1805

|

Cocoa

powder, not containing added sugar or sweetening matter

|

|

11

|

1806

|

Chocolates

and other food preparations containing cocoa

|

|

12

|

1901

|

Malt

extract; food preparations of flour, groats, meal, starch or malt extract

(not containing cocoa or <40% cocoa); preparations of milk products (not

containing cocoa or <5% cocoa)

|

|

13

|

1904

|

All

goods i.e. Corn flakes, bulgur wheat, prepared foods from cereal flakes

|

|

14

|

1905

|

Pastry,

cakes, biscuits & other bakers’ wares (with or without cocoa); communion

wafers, cachets, sealing wafers, rice paper etc.

|

|

15

|

2101

11, 2101 12 00

|

Extracts,

essences & concentrates of coffee; preparations with basis of coffee

|

|

16

|

2101

20

|

Extracts,

essences & concentrates of tea or mate; preparations with basis of

tea/mate

|

|

17

|

2104

|

Soups,

broths and preparations therefor; homogenised composite food preparations

|

|

18

|

2105

00 00

|

Ice

cream and other edible ice, whether or not containing cocoa

|

|

19

|

2106

|

Food

preparations not elsewhere specified or included

|

|

20

|

2201

|

Waters

(natural, artificial mineral waters, aerated waters), not containing added

sugar or flavouring

|

|

21

|

2202

99

|

Plant-based

milk drinks, ready for direct consumption

|

|

22

|

3503

|

Gelatin

& derivatives; isinglass; other animal-origin glues (excluding casein

glues of 3501)

|

|

23

|

3505

|

Dextrins

& other modified starches (e.g., pregelatinised, esterified);

starch-based glues

|

Food Sector – GST Rate Change (From 18% →

40%)

|

S.

No.

|

Chapter

/ Heading / Sub-heading / Tariff Item

|

Description

of Goods

|

|

1

|

2202

91 00, 2202 99

|

Other

non-alcoholic beverages

|

Food Sector – GST Rate Change (From 28% →

40%)

|

S.

No.

|

Chapter

/ Heading / Sub-heading / Tariff Item

|

Description

of Goods

|

|

1

|

2106

90 20

|

*Pan

masala

|

|

2

|

2202

10

|

All

goods [including aerated waters], containing added sugar or other sweetening

matter or flavoured

|

|

3

|

2202

99 90

|

Caffeinated

Beverages

|

|

4

|

2202

|

Carbonated

Beverages of Fruit Drink or Carbonated Beverages with Fruit Juice

|

FAQs Clarification on GST Rate Changes

1. Exemption to UHT Milk

- Earlier Position:

Dairy milk (other than UHT milk) was already exempt.

- Now:

UHT (Ultra High Temperature) milk has been exempted to align tax

treatment.

- Plant-based milk drinks:

- Earlier – Plant-based milk (except

soya milk) at 18%, Soya milk at 12%.

- Now – Both reduced to 5%.

2. 40% Rate on Other

Non-Alcoholic Beverages

- Rationale: To maintain uniform tax

treatment for similar goods and avoid misclassification/disputes.

3. GST Rate on Food

Preparations (NES)

- Food preparations not elsewhere

specified will attract 5% GST.

4. Indian Breads –

Exemption

- Earlier:

- Pizza bread, roti, porotta, paratha

etc. attracted different rates.

- Ordinary bread was already exempt.

- Now:

All Indian breads, by whatever name called, have been exempted.

5. Carbonated Beverages

of Fruit Drink/Fruit Juice

- Earlier:

These attracted Compensation Cess + GST.

- Now:

Compensation Cess has ended. GST rate increased to 40% to maintain

pre-rationalisation tax level.

6. Paneer vs. Cheese –

Differential Treatment

- Paneer (chena):

- Unpackaged – Nil rate

(already exempt earlier).

- Pre-packaged & labelled – Now exempted.

- Cheese (other than paneer):

Still taxed.

- Reason:

Paneer is Indian cottage cheese, mostly produced in small-scale sector.

This change supports domestic producers.

7. Natural Honey vs.

Artificial Honey

- Differential tax treatment

introduced.

- Reason:

To promote natural honey over artificial substitutes.

Conclusion

The 56th GST Council

Meeting marks a major rate rationalisation in the food sector.

- Daily essentials

like milk, paneer, breads, and pizza bread are now exempt.

- Healthy options

like nuts, dried fruits, soya milk, and fruit-based drinks are more

affordable at 5% GST.

- Luxury/health-risk products

like pan masala, caffeinated and carbonated beverages face higher

GST (40%).

This two-pronged

approach balances relief to consumers with discouragement of

harmful consumption while ensuring simplified tax treatment and

reducing classification disputes.

Disclaimer: All the Information is based on the notification, circular advisory and order issued by the Govt. authority and judgement delivered by the court or the authority information is strictly for educational purposes and on the basis of our best understanding of laws & not binding on anyone.

Click here