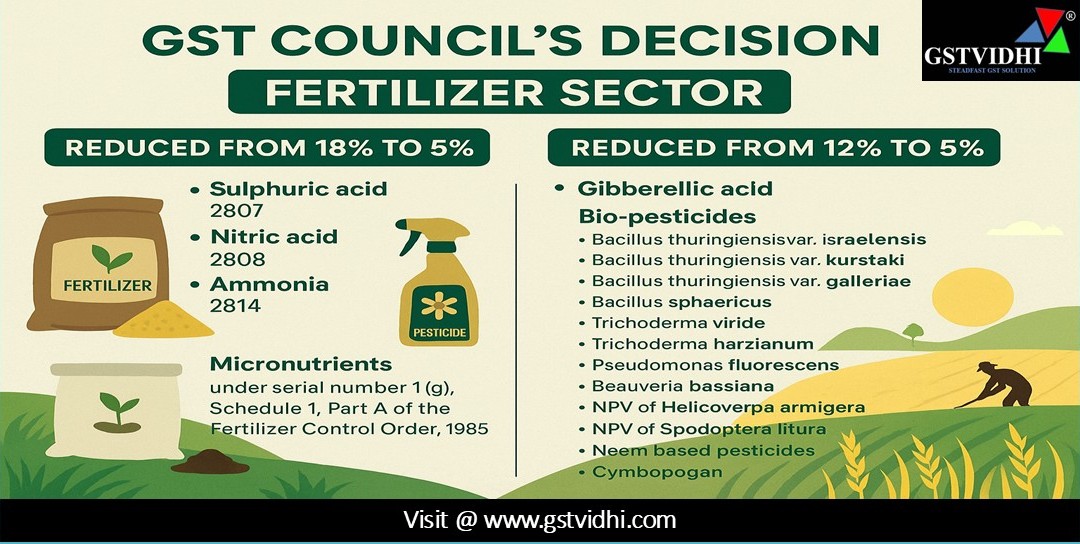

New GST rates on fertilizers (Raw Material - Sulphuric Acid,

Nitric Acid, Ammonia), bio-pesticides, and micronutrients

The 56th GST Council

Meeting, held at Sushma Swaraj Bhavan, New Delhi under the

chairpersonship of Union Finance Minister Smt. Nirmala Sitharaman,

brought significant relief to the fertilizer sector. The Council recommended

major GST rate cuts on fertilizers, bio-pesticides, and micronutrients,

with the aim of reducing input costs for farmers and ensuring affordable access

to agricultural essentials.

These decisions are

expected to benefit farmers, the common man, and the aspirational middle

class by lowering agricultural production costs and supporting food

security.

GST Rate

Change (From 18% to 5%)

The GST Council, in its

56th meeting, recommended a major relief for the fertilizer industry by

reducing the tax rate from 18% to 5% on key raw materials used in

fertilizer manufacturing.

Products Covered under

Rate Reduction:

|

S.

No.

|

Chapter

/ Heading / Sub-heading / Tariff item

|

Description

of Goods

|

GST

Rate (Old → New)

|

|

1

|

2807

|

Sulphuric

acid

|

18%

→ 5%

|

|

2

|

2808

|

Nitric

acid

|

18%

→ 5%

|

|

3

|

2814

|

Ammonia

|

18%

→ 5%

|

GST Rate

Change (From 12% to 5%)

The GST Council has

provided further relief to the agriculture sector by reducing GST from 12%

to 5% on important growth regulators, bio-pesticides, and micronutrients.

Products Covered under

Rate Reduction:

|

S.

No.

|

Chapter

/ Heading / Sub-heading / Tariff item

|

Description

of Goods

|

GST

Rate (Old → New)

|

|

1

|

29

or 380893

|

Gibberellic

acid

|

12%

→ 5%

|

|

2

|

3808

|

Bio-pesticides,

namely:

1. Bacillus thuringiensis var. israelensis

2. Bacillus thuringiensis var. kurstaki

3. Bacillus thuringiensis var. galleriae

4. Bacillus sphaericus

5. Trichoderma viride

6. Trichoderma harzianum

7. Pseudomonas fluorescens

8. Beauveria bassiana

9. NPV of Helicoverpa armigera

10. NPV of Spodoptera litura

11. Neem-based pesticides

12. Cymbopogan

|

12%

→ 5%

|

|

3

|

28

or 38

|

Micronutrients

covered under Serial No. 1(g), Schedule 1, Part (A) of the Fertilizer

Control Order, 1985, manufactured by registered manufacturers under FCO,

1985

|

12%

→ 5%

|

Note: The

changes in GST rates of all goods except pan masala, gutkha, cigarettes,

chewing tobacco products like zarda, unmanufactured tobacco and bidi, will be

implemented with effect from 22nd September 2025.

Expected

Impact

1. For

Farmers: Reduced cost of fertilizers and plant nutrients,

lowering overall cultivation expenses.

2. For

Fertilizer Industry: Boost to domestic manufacturers by

lowering tax burden on key raw materials.

3. For

Economy: Support to agriculture sector growth and alignment

with “Atmanirbhar Bharat” vision.

4. For

Environment: Promotion of bio-based and

eco-friendly pesticides over chemical alternatives.

Conclusion

The GST Council’s

decision to rationalize tax rates in the fertilizer sector marks a farmer-friendly

reform. By reducing GST on critical inputs from 18%/12% to 5%, the

Council has addressed a long-pending demand of both fertilizer manufacturers

and the agricultural community.

This step is likely to reduce

the price of fertilizers, encourage sustainable farming practices, and

strengthen India’s agricultural economy.

Disclaimer: All the Information is based on the notification, circular advisory and order issued by the Govt. authority and judgement delivered by the court or the authority information is strictly for educational purposes and on the basis of our best understanding of laws & not binding on anyone.

Click here