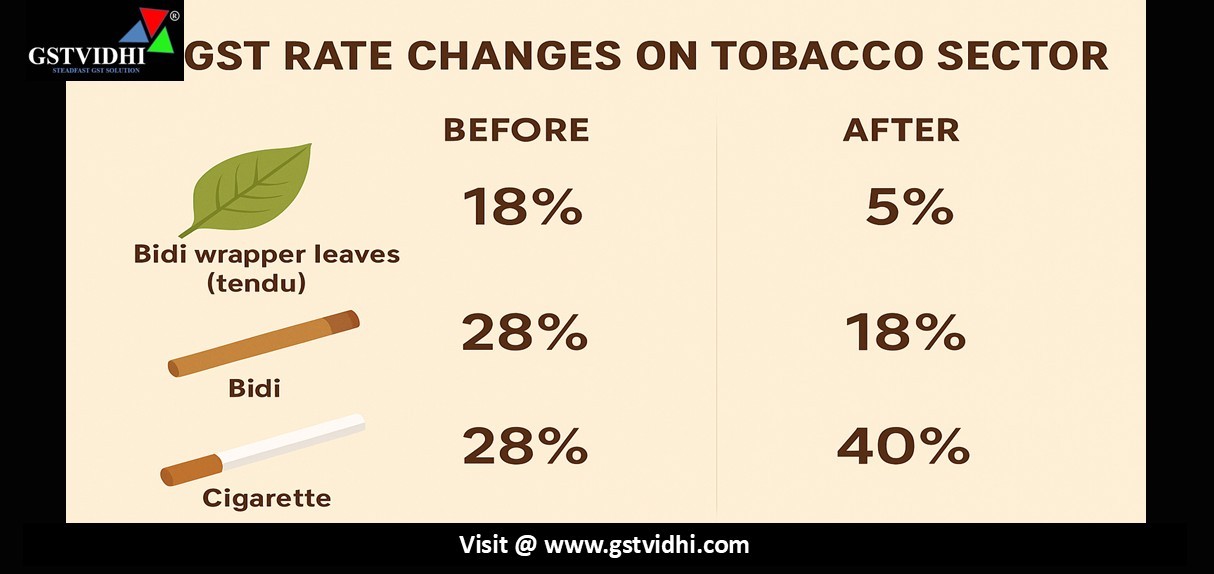

GST Rate Changes in the Tobacco Sector – 56th GST Council

Meeting

The 56th meeting of the

GST Council, chaired by Union Finance Minister Smt. Nirmala Sitharaman, was

held on 3rd September 2025 at Sushma Swaraj Bhavan, New Delhi. Among the key

highlights, the Council made major recommendations for the tobacco sector, balancing

the interests of rural workers engaged in bidi production with the government’s

objective of discouraging tobacco consumption.

1. Reduction in GST Rates

(From 18% to 5%)

|

S.

No.

|

Chapter/Heading/

Sub-heading/ Tariff Item

|

Description

of Goods

|

Old

Rate

|

New

Rate

|

|

1

|

1404

90 10

|

Bidi

wrapper leaves (tendu)

|

18%

|

5%

|

|

2

|

1404

90 50

|

Indian

katha

|

18%

|

5%

|

Reduction in GST on Bidi

(From 28% to 18%)

|

S.

No.

|

Chapter/Heading

|

Description

of Goods

|

Old

Rate

|

New

Rate

|

|

1

|

2403

|

Bidi

|

28%

|

18%

|

Increase in GST on Other

Tobacco Products

(From 28% to 40%)

|

S.

No.

|

Chapter/Heading/

Sub-heading/ Tariff Item

|

Description

of Goods

|

Old

Rate

|

New

Rate

|

|

1

|

2401

|

Unmanufactured

tobacco; tobacco refuse [other than tobacco leaves]

|

28%

|

40%

|

|

2

|

2402

|

Cigars,

cheroots, cigarillos and cigarettes, of tobacco or of tobacco substitutes

|

28%

|

40%

|

|

3

|

2403

|

Other

manufactured tobacco and substitutes; “homogenised” or “reconstituted”

tobacco; tobacco extracts and essences

|

28%

|

40%

|

|

4

|

2404

11 00

|

Products

containing tobacco or reconstituted tobacco and intended for inhalation

without combustion

|

28%

|

40%

|

|

5

|

2404

19 00

|

Products

containing tobacco or nicotine substitutes and intended for inhalation

without combustion

|

28%

|

40%

|

Summary Insight

- Inputs for bidi industry (tendu

leaves, Indian katha) – rate reduced to 5%

- Finished bidi products – rate reduced

to 18%

- All other tobacco products (including

cigarettes, cigars, e-tobacco products, and substitutes) – rate increased

to 40%

Implementation Timeline

- For cigarettes, chewing tobacco,

zarda, unmanufactured tobacco, and bidi → the current GST rate +

Compensation Cess continues for now.

- The new rates will be implemented

later, once the loan and interest liabilities related to the Compensation

Cess are fully discharged.

Conclusion

The Council has taken a balanced

policy approach:

- Relief for bidi industry and rural

employment through reduced GST on raw materials

and bidi.

- Higher tax burden on cigarettes,

cigars, and other harmful tobacco products,

aligning with the health and revenue objectives of the government.

This dual move is

expected to safeguard livelihoods while continuing to discourage

tobacco consumption across the country.

Disclaimer: All the Information is based on the notification, circular advisory and order issued by the Govt. authority and judgement delivered by the court or the authority information is strictly for educational purposes and on the basis of our best understanding of laws & not binding on anyone.

Click here