GST Council Brings Relief on Stationery Items: Key Rate Changes

Announced

The 56th meeting of

the GST Council, chaired by Union Finance & Corporate Affairs Minister Smt.

Nirmala Sitharaman, was held on 3rd September 2025 at Sushma Swaraj

Bhavan, New Delhi. The Council made several recommendations aimed at

rationalising GST rates and providing relief to the common man. A major

highlight was the reduction and exemption of GST on a range of stationery

items, directly benefiting students, parents, and the education sector.

GST Rate Changes –

Education Sector

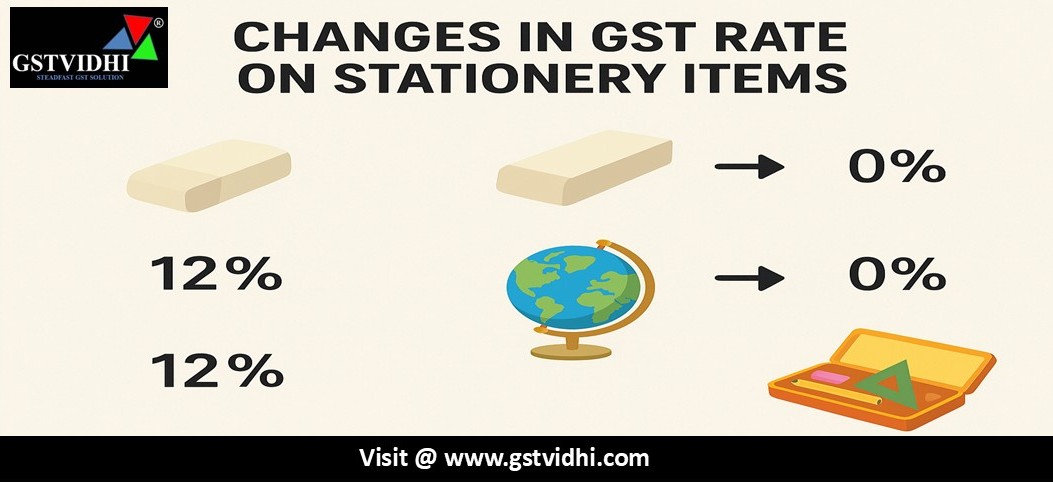

(A) From 5% to Nil

|

S.

No.

|

Chapter

/ Heading / Tariff Item

|

Description

of Goods

|

|

1

|

4016

|

Erasers

|

(B) From 12% to Nil

|

S.

No.

|

Chapter

/ Heading / Tariff Item

|

Description

of Goods

|

|

1

|

4905

|

Maps

and hydrographic or similar charts of all kinds, including atlases, wall

maps, topographical plans and globes, printed

|

|

2

|

8214

|

Pencil

sharpeners

|

|

3

|

9608,

9609

|

Pencils

(including propelling or sliding pencils), crayons, pastels, drawing

charcoals and tailor’s chalk

|

|

4

|

4820

|

Exercise

book, graph book, laboratory note book and notebooks

|

(C) From 12% to 5%

|

S.

No.

|

Chapter

/ Heading / Tariff Item

|

Description

of Goods

|

|

1

|

7310

or 7326

|

Mathematical

boxes, geometry boxes and colour boxes

|

Impact on Consumers and

Education Sector

The decision to reduce

and exempt GST on essential stationery items is expected to:

- Lower the cost of basic learning

materials, easing the financial burden on

students and households.

- Benefit schools, colleges, and

coaching institutions by reducing procurement costs of commonly used

supplies.

- Encourage wider access to quality

education by making fundamental learning tools more affordable.

This rationalisation

aligns with the government’s broader vision of supporting the aspirational

middle class and promoting education affordability.

Conclusion

The GST Council’s

decision to reduce tax rates on stationery items represents a significant step

towards making education-related expenses lighter for families. With erasers,

pencils, sharpeners, crayons, maps, and notebooks becoming tax-free, and geometry

sets now available at a reduced tax rate of 5%, the reform is set to benefit

millions of students across the country.

The new rates, effective

from 22nd September 2025, mark an important reform in India’s GST

framework, ensuring essential educational supplies are more accessible and

affordable.

Disclaimer: All the Information is based on the notification, circular advisory and order issued by the Govt. authority and judgement delivered by the court or the authority information is strictly for educational purposes and on the basis of our best understanding of laws & not binding on anyone.

Click here