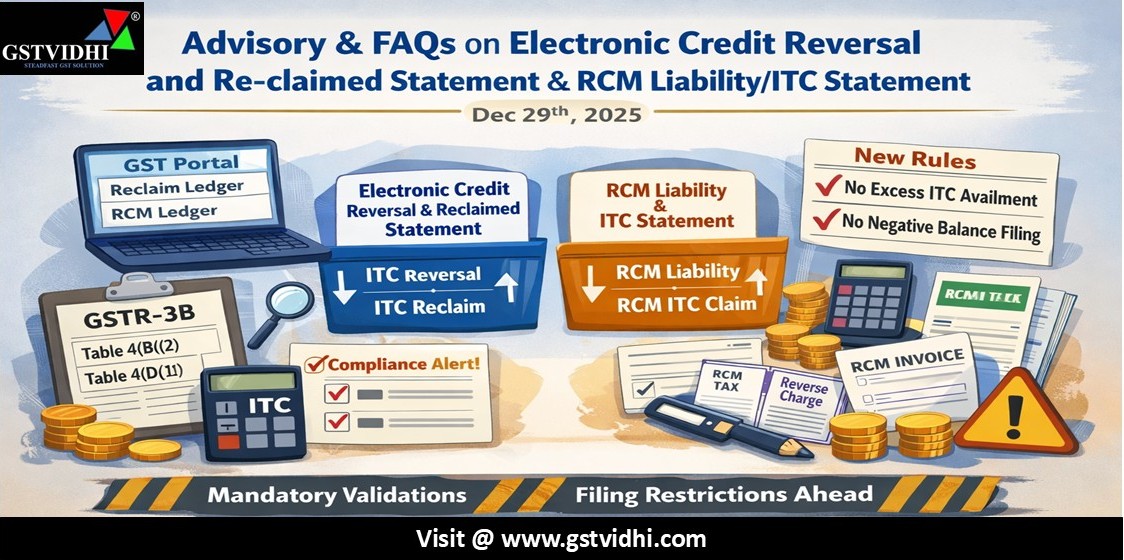

Advisory & FAQs on Electronic Credit Reversal and Re-claimed

Statement and RCM Liability/ITC Statement

(GSTN Advisory dated 29 December 2025)

1.

Introduction – Why this Advisory is Important:

The GST law allows

taxpayers to avail Input Tax Credit (ITC) subject to conditions and also

requires reversal of ITC in specific situations such as non-payment to vendors,

ineligible credits, or provisional reversals. Similarly, under the Reverse

Charge Mechanism (RCM), tax must first be paid and only then ITC can be

claimed.

Over the years, GST

authorities noticed frequent clerical errors, excess reclaim of ITC,

premature RCM ITC claims, and mismatch between liability paid and ITC availed.

To address these issues and to bring system-based discipline, GSTN

introduced two important system-generated statements (popularly called

ledgers):

1. Electronic

Credit Reversal and Re-claimed Statement (ITC Reclaim Ledger)

2. RCM

Liability/ITC Statement (RCM Ledger)

The advisory dated 29

December 2025 makes it clear that very soon the GST portal will strictly

block excess ITC availment, and taxpayers will not be allowed to file

GSTR-3B if these ledgers show negative balances or mismatches.

This article explains

both statements, upcoming validations, and practical steps taxpayers must take

to remain compliant.

2.

Electronic Credit Reversal and Re-claimed Statement – Concept and Purpose:

The Electronic Credit

Reversal and Re-claimed Statement was introduced to ensure accurate

tracking of ITC that is temporarily reversed and later reclaimed.

This statement is

applicable:

- From August 2023 onwards for monthly

filers, and

- From July–September 2023 quarter

onwards for quarterly filers.

What does this statement

capture?

This statement tracks:

- ITC reversed temporarily

in Table 4(B)(2) of GSTR-3B, and

- ITC reclaimed later

in:

- Table 4(A)(5), and

- Table 4(D)(1) of GSTR-3B.

In simple terms, it acts

as a memory ledger of how much ITC you reversed earlier and how much of

that reversal you have already reclaimed.

3. Filing

Experience So Far – Warning Without Restriction:

At present, if a taxpayer

tries to reclaim more ITC in Table 4(D)(1) than what is available in the

Reclaim Ledger, the system:

- Shows a warning message, but

- Still allows filing of GSTR-3B.

Because of this

flexibility, many taxpayers ended up with negative closing balances,

indicating excess reclaim of ITC.

4. Opening

Balance Facility – Multiple Chances Given:

GSTN has been fairly

liberal and provided multiple opportunities to taxpayers to:

- Declare opening balance of ITC

which was reversed earlier but not reclaimed, and

- Correct historical mismatches that

existed prior to introduction of this statement.

This opening balance

facility was meant to ensure that legacy reversals were properly reflected and

future compliance remained clean.

5. How to

View the Electronic Credit Reversal and Re-claimed Statement:

Taxpayers can view this

statement by following the below navigation on the GST portal:

Dashboard → Services →

Ledger → Electronic Credit Reversal and Re-claimed

Regular review of this

ledger is now critical, as it will directly impact the ability to file

returns.

6.

Introduction of RCM Liability/ITC Statement – A Second Control Ledger:

To further strengthen

compliance under Reverse Charge Mechanism, GSTN introduced another statement

called the RCM Liability/ITC Statement.

This statement is

applicable:

- From August 2024 onwards for monthly

filers, and

- From July–September 2024 quarter

for quarterly filers.

What does the RCM Ledger

track?

The RCM Ledger captures:

- RCM liability reported

in Table 3.1(d) of GSTR-3B, and

- RCM ITC claimed

in:

- Table 4(A)(2) (RCM –

services), and

- Table 4(A)(3) (RCM – inward

supplies from ISD, etc.).

This ensures that RCM

ITC is claimed only after tax is paid.

7. Warning

Mechanism in RCM Ledger:

Currently, if a taxpayer

claims RCM ITC exceeding:

- Closing balance of the RCM Ledger plus

- RCM liability reported in Table

3.1(d) of the same return,

The system generates a warning,

but still allows return filing.

However, this is about to

change.

8. Opening

Balance and Amendment Facility in RCM Ledger:

Just like the ITC Reclaim

Ledger, taxpayers were given multiple chances to:

- Declare opening balance of excess

RCM liability or ITC, and

- Correct past errors that occurred before

implementation of this statement.

This facility was a one-time

compliance correction window and should be utilised carefully.

9.

Accessing the RCM Liability/ITC Statement:

The RCM Ledger can be

accessed as follows:

Services → Ledger → RCM

Liability/ITC Statement

Taxpayers dealing

frequently with RCM transactions should monitor this statement every return

period.

10. Major

Change Ahead – Hard System Validations:

GSTN has now clearly

informed taxpayers that shortly, the portal will not allow:

- Negative balances in either ledger,

or

- Excess ITC availment beyond available

balance.

New Validations to be

Enforced

(a) For ITC Reclaim

Ledger

The ITC reclaimed in Table

4(D)(1) shall be less than or equal to:

Closing balance of ITC

Reclaim Ledger

plus

ITC reversed in Table 4(B)(2) of the current GSTR-3B.

(b) For RCM Ledger

RCM ITC claimed in Table

4(A)(2) & 4(A)(3) shall be less than or equal to:

Closing balance of RCM

Liability/ITC Statement

plus

RCM liability paid in Table 3.1(d) of the same GSTR-3B.

11.

Consequences of Negative Closing Balance – Filing Will Be Blocked:

If a taxpayer already has

a negative closing balance in either ledger, the system will not

allow filing of GSTR-3B until corrective action is taken.

(a) Negative Balance in

ITC Reclaim Ledger

This means excess ITC

was reclaimed earlier.

To file GSTR-3B, the

taxpayer must:

- Reverse the excess ITC in Table

4(B)(2) of the current return.

If no ITC is available in

the current period:

- The reversed amount will be added

to output tax liability and must be paid in cash.

Example:

If the ledger shows –₹10,000, the taxpayer must reverse ₹10,000 in Table

4(B)(2) to proceed with filing.

(b) Negative Balance in

RCM Liability/ITC Statement

This indicates excess

RCM ITC claimed earlier.

To correct this, the

taxpayer has two options:

1. Pay

additional RCM liability in Table 3.1(d) equivalent to

the negative balance, OR

2. Reduce

RCM ITC claim in Table 4(A)(2) or 4(A)(3) in the

current return.

Example:

If the RCM Ledger shows –₹5,000, the taxpayer must either:

- Pay ₹5,000 as RCM liability, or

- Reduce RCM ITC claim by ₹5,000.

Only after this

correction will return filing be allowed.

12. FAQs –

Key Clarifications

The FAQs issued by GSTN

largely reiterate the above principles and clearly indicate that system-based

compliance is now mandatory, not optional.

The emphasis is on:

- Correct reporting,

- No excess reclaim or premature ITC,

and

- Matching of liability paid and ITC

availed.

13.

Conclusion

The GST portal is

steadily moving towards a fully system-controlled compliance regime,

where manual flexibility will no longer be available. The introduction

and strict enforcement of the Electronic Credit Reversal and Re-claimed

Statement and the RCM Liability/ITC Statement marks a decisive step

in that direction.

Taxpayers who proactively

review and correct their ledgers will face smooth return filing, while

those ignoring these statements may soon find themselves blocked at the

filing stage with forced reversals or cash payments.

Early action, proper

reconciliation, and disciplined reporting are the only way forward under GST

Disclaimer: All the Information is based on the notification, circular advisory and order issued by the Govt. authority and judgement delivered by the court or the authority information is strictly for educational purposes and on the basis of our best understanding of laws & not binding on anyone.

Press On Click Here To Download Order File

Click here