What Is Financial Leverage / How To Calculate Financial Leverage

/ Difference Between Operating Leverage Or Financial Leverage

Meaning

Financial leverage refers

to the use of fixed financial costs (such as interest on debt or

preference dividends) to magnify the effect of changes in EBIT (Earnings

Before Interest and Tax) on the Earnings Per Share (EPS) available

to equity shareholders.

In other words, it is the

firm's capacity to use borrowed funds or preference capital (with fixed

charges) to enhance returns for equity holders.

Definition

“Financial leverage is

the ability of a firm to use fixed financial charges to magnify the effects of

changes in EBIT on EPS.” – Gitman

This concept is also

known as Trading on Equity, which involves using long-term debt and

preference capital along with equity to maximize shareholders’ returns.

Types of

Financial Leverage

1. Favourable

Financial Leverage (Positive): Occurs when the return

on assets acquired with borrowed funds is greater than the cost

of funds.

2. Unfavourable

Financial Leverage (Negative): Occurs when the cost

of funds exceeds the return generated by those funds.

Example 1:

Basic Calculation of Financial Leverage

Capital Structure

|

Particulars

|

Amount

(`)

|

|

Equity

Share Capital

|

1,00,000

|

|

10%

Preference Share Capital

|

1,00,000

|

|

8%

Debentures

|

1,25,000

|

|

EBIT

|

50,000

|

Tax Rate

= 50%

Solution: Profit

Statement

|

Particulars

|

Amount

(`)

|

|

EBIT

|

50,000

|

|

Less:

Interest on Debentures (8% of 1,25,000)

|

10,000

|

|

EBT

(Profit Before Tax)

|

40,000

|

|

Less:

Tax (50% of 40,000)

|

20,000

|

|

Net

Profit

|

20,000

|

Financial Leverage

50,000 / 40,000 = 1.25

Uses of

Financial Leverage

- Measures sensitivity of EPS to

changes in EBIT.

- Helps assess risk in capital

structure.

- Aids in decision-making for using

debt vs equity.

- Identifies the impact of fixed

financial costs on profitability.

Example 2:

Impact of Financial Plans on EPS

XYZ Ltd.

needs `50,000. Two plans are considered:

|

Particulars

|

Plan

A

|

Plan

B

|

|

Debentures

@10%

|

40,000

|

10,000

|

|

Equity

Share Capital

|

10,000

|

40,000

|

|

No.

of Equity Shares (₹10 each)

|

1,000

|

4,000

|

Case 1: EBIT = ₹5,000

|

Particulars

|

Plan

A

|

Plan

B

|

|

EBIT

|

5,000

|

5,000

|

|

Less:

Interest

|

4,000

|

1,000

|

|

EBT

|

1,000

|

4,000

|

|

Less:

Tax @ 50%

|

500

|

2,000

|

|

Earnings

to Equity

|

500

|

2,000

|

|

No.

of Shares

|

1,000

|

4,000

|

|

EPS

|

0.50

|

0.50

|

Case 2: EBIT = ₹12,500

|

Particulars

|

Plan

A

|

Plan

B

|

|

EBIT

|

12,500

|

12,500

|

|

Less:

Interest

|

4,000

|

1,000

|

|

EBT

|

8,500

|

11,500

|

|

Less:

Tax @ 50%

|

4,250

|

5,750

|

|

Earnings

to Equity

|

4,250

|

5,750

|

|

No.

of Shares

|

1,000

|

4,000

|

|

EPS

|

4.25

|

1.44

|

Observation:

Plan A shows higher EPS at higher EBIT due to higher leverage, but carries more

risk if EBIT is low.

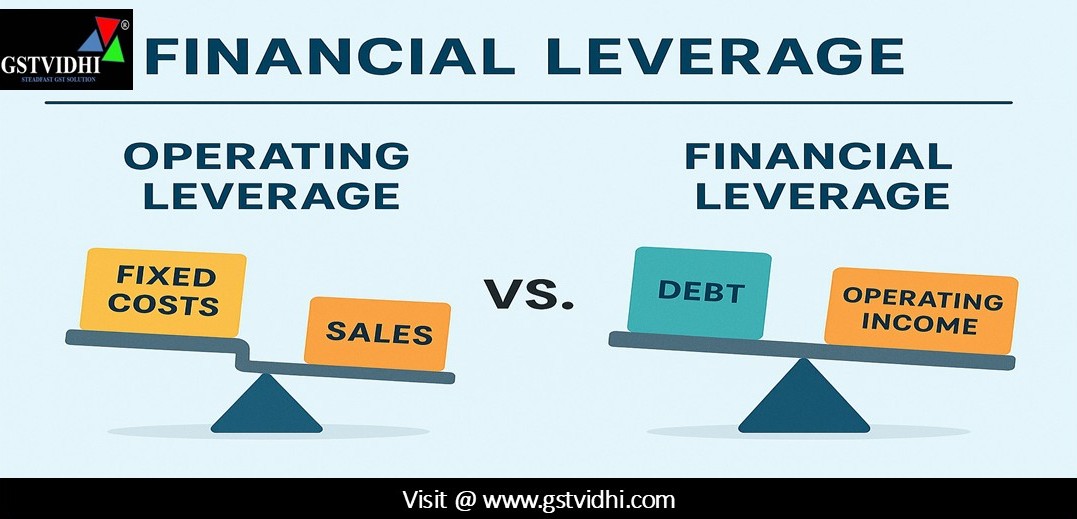

Difference

between Operating Leverage and Financial Leverage

|

Basis

|

Operating

Leverage

|

Financial

Leverage

|

|

Activity

|

Investment

activity

|

Financing

activity

|

|

Cost

Involved

|

Fixed

Operating Costs

|

Fixed

Financial Costs (Interest, Preference Dividend)

|

|

Impact

|

Sales

to EBIT

|

EBIT

to EPS

|

|

Formula

|

%

Change in EBIT / % Change in Sales

|

%

Change in EPS / % Change in EBIT

|

|

Trading

on Equity

|

Not

possible

|

Possible

|

|

Dependency

|

Fixed

& Variable Cost Structure

|

Operating

Profits

|

|

Tax/Interest

Impact

|

Not

affected

|

Affected

by Tax and Interest Rates

|

Key

Concepts

Financial Break-Even

Point

The level of EBIT at

which a firm just covers its fixed financial costs, i.e., EPS = 0.

Indifference Point

The EBIT level at which two

financing plans yield the same EPS. Beyond this point, the more leveraged

plan gives higher EPS.

Disclaimer: All the Information is strictly for educational purposes and on the basis of our best understanding of laws & not binding on anyone.

Click here