Payback Period Method: A Simple Explanation

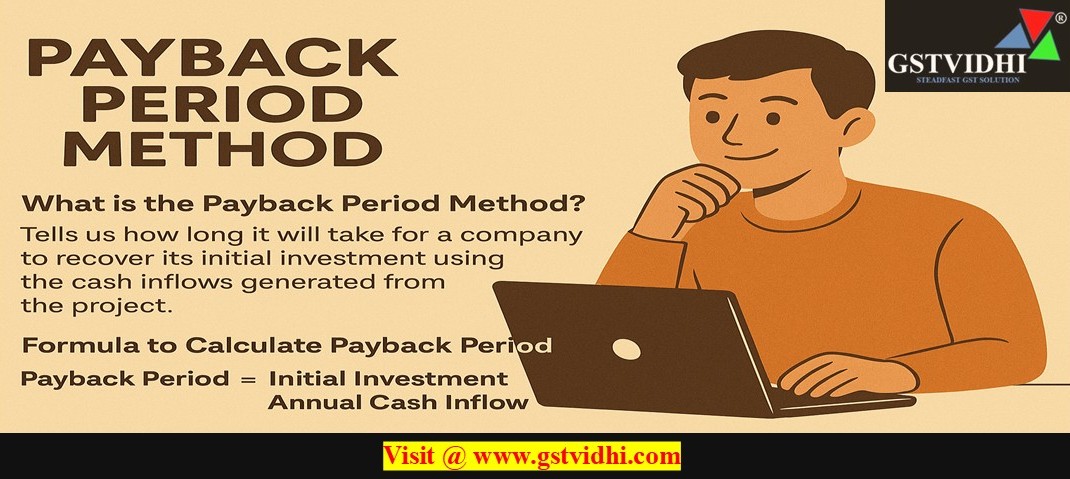

What is the

Payback Period Method?

The Payback Period

Method is one of the easiest ways to evaluate whether a business project is

worth investing in. It tells us how long it will take for a company to recover

its initial investment using the cash inflows generated from the

project.

In simple terms, it

answers this question:

“How many years will it

take to get back the money we spent?”

📘 Formula to Calculate

Payback Period

If the project generates

the same amount of cash every year (uniform cash flows), then:

Payback Period=Initial Investment

/ Annual Cash Inflow

🔹 Example 1: Uniform Cash

Inflows

Suppose a company invests

₹25,000 in a machine, and every year it earns ₹5,000 from it.

Payback Period=₹25,000

/ ₹5,000 =5 years

This means the company

will recover the money in 5 years.

When Cash

Flows are Uneven

When the cash inflows are

not the same every year, we use cumulative cash inflows to find

out in which year the investment is recovered.

🔹 Example 2: Uneven Cash

Inflows

Let’s say a project needs

₹25,000, and generates:

|

Year

|

Cash

Inflow (₹)

|

Cumulative

Inflow (₹)

|

|

1

|

6,000

|

6,000

|

|

2

|

9,000

|

15,000

|

|

3

|

7,000

|

22,000

|

|

4

|

6,000

|

28,000

|

By the end of Year 3, we

recover ₹22,000. We still need ₹3,000 more.

In Year 4, we get ₹6,000.

So, we will recover the remaining ₹3,000 in:

Extra months=₹3,000/₹6,000=0.5 years

So, Payback Period = 3

+ 0.5 = 3.5 years

Decision

Rule

- Accept the project

if the payback period is less than the maximum time allowed by the

company.

- Reject the project

if the payback period is more than the allowed time.

- Among multiple projects, choose

the one with the shortest payback period.

Advantages

of the Payback Period Method

1. Very

easy to understand and calculate.

2. Helps

firms that face cash shortage to choose projects that recover money

quickly.

3. Helps

understand the risk level—shorter payback means lower risk.

4. Useful

in projects where political or technological risks are high (e.g.,

electronics or foreign projects).

5. Helps

maintain liquidity—you know when your money comes back.

Disadvantages

of Payback Period Method

1. Ignores

time value of money – ₹1 today is more valuable than ₹1 next

year. Payback method does not consider this.

2. Ignores

cash after the payback period – It does not consider

how much profit a project makes after the money is recovered.

3. Does

not consider residual value – If you can sell the machine later,

that money is ignored.

4. Doesn’t

consider cost of capital – It doesn’t check if your return is

more than your borrowing cost.

When is the

Payback Period Method Useful?

It is useful in the

following cases:

- When a company wants to recover

money quickly

- When borrowing cost is high

- When future returns are uncertain

- When operating in politically

risky countries

Conclusion

The Payback Period

Method is a helpful initial screening tool, especially for small

businesses or students learning investment evaluation. While it does not give a

full picture of profitability, it clearly shows how quickly the investment

will be returned—making it a valuable method when liquidity and risk

are important.

Disclaimer: All

the Information is strictly for educational purposes and on the basis of our

best understanding of laws & not binding on anyone.

Click here